In Business Intelligence & Analytics

What's the secret recipe for a future Fintech product? How to combine Machine Learning with User Experience and make an app that will generate brand lovers?

Fintech Industry Leader

Hi everyone! I am now a fintech industry leader at Intellias. Not the most obvious position here, honestly. Let me describe you a little bit of what I actually do.

I discover the latest tech trends in the financial industry and analyze where the next big growth opportunity may come up. Once you have different automation and digitization project succeed (and, unfortunately, fail) and impression just how important and cx driven approach to banking is.

What makes me qualified to do all the things? I wore many heads over the last decade: work as a financial analyst, business analyst and even did some trading on the side. And that's how i got to interiors: a place where we enable you with the right knowledge that and resources to build a great new product.

During my research I happened to work out the optimal formula for gross hungry fintech: CX is ML plus UX, and it actually got me the speaking engagement.

But before we jump into that, I have a Question: who is the most remarkable, extraordinary app growing on steroids and threatening fintech unicorns? Is it a wealth management app? Is it a new personal finance management tool? No, it's Tik tok.

Tik Tok is a Super App

You've probably heard all those numbers about Tik Tok’s phenomenal growth over the last two years: the most downloaded app, the most engaging app and so on. What you may have missed amid the Tik Tok craze is this bit of news: by dance, TikTok Chinese parent company actually won their western first born to graduate to something more than a random challenge generating machine.

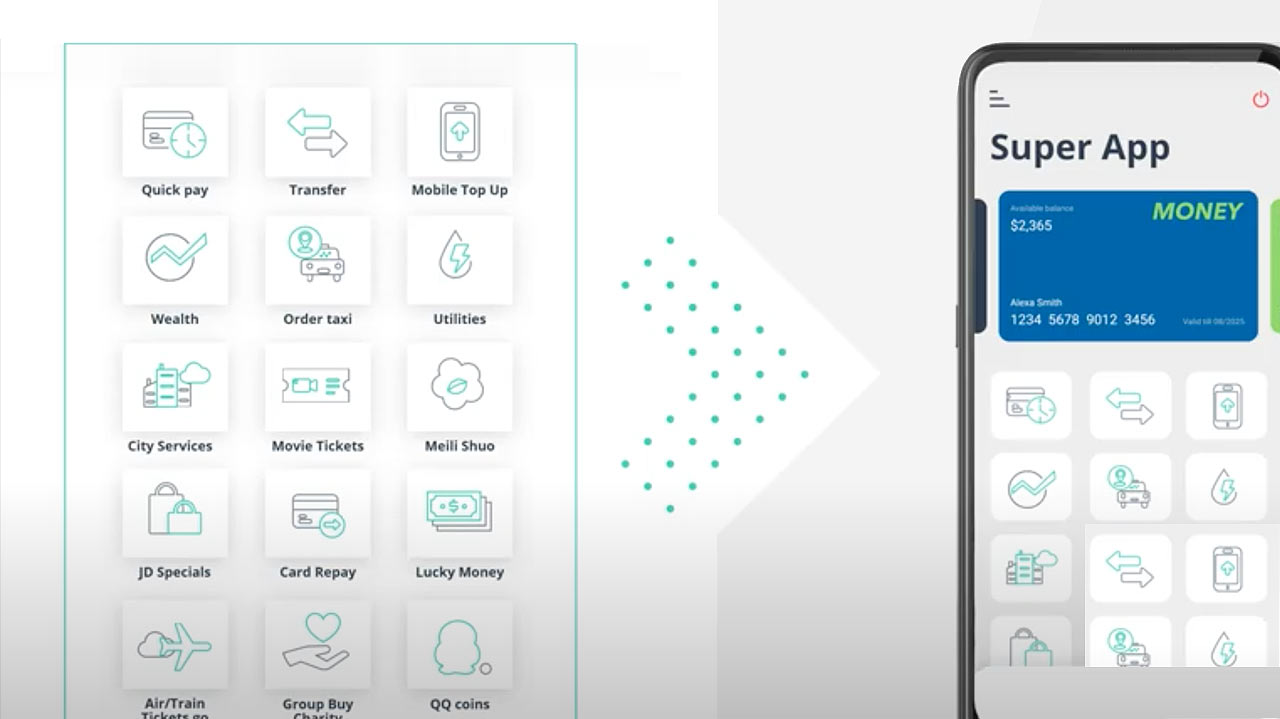

They envision Tik Tok as a super app. What is a super app? It is a product that combines a bunch of services and allows search party developers to integrate mini programs inside the main product. In essence, it's just which type of army knife of a product that has all the services a user may need accessible via a single interface.

Think anything from payments and banking to doctor's appointments booking or food ordering. All of these programs are tightly interconnected, complementing and reinforcing each other, so that the user don't get tempted to switch to another app.

Circling back to Tik Tok, by dance already launched a consumer landing app in its home market in lane 2019. As the rumor goes, a new fintech products might be on the way for Tik Tok users.

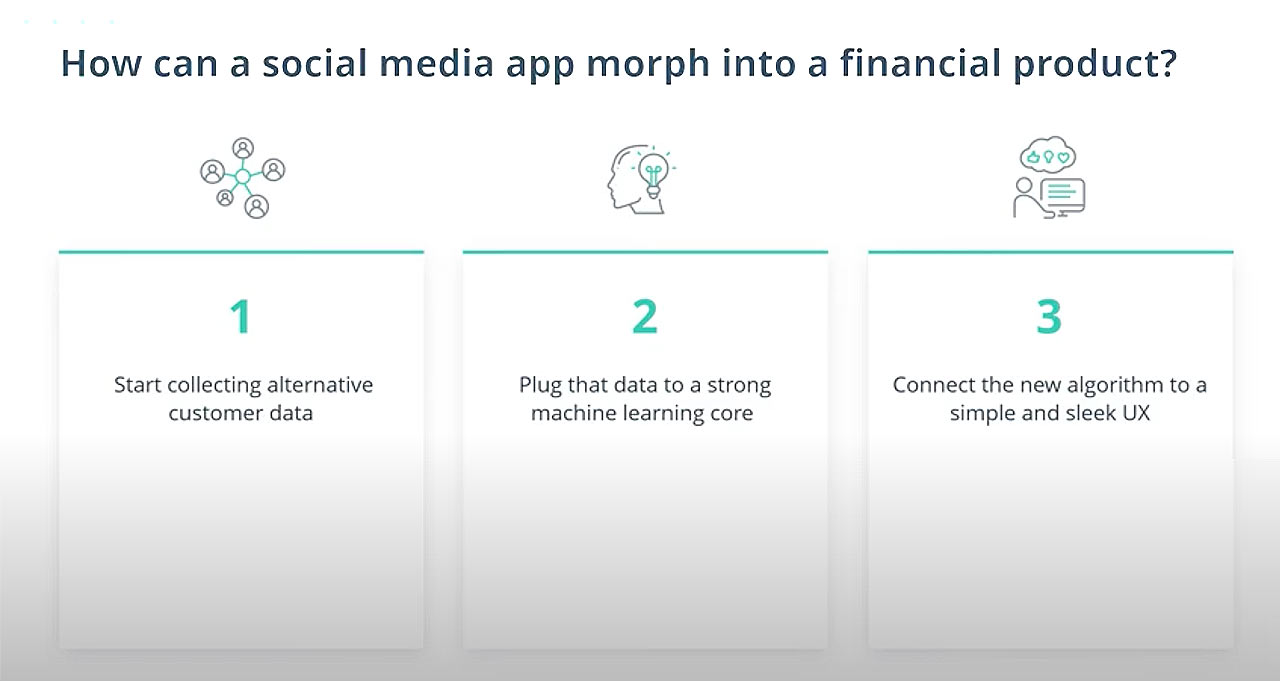

But how can a social media app morph if to a financial product? In several steps, of course. First you start collecting customer data: connections, conversations, geolocation. Next, you plug the data to a strong machine learning code, and, finally, you connect the new algorithm to a simple and slick UX.

All of this free thing can be bundled into an addictive social media app: the one showing you the content you want 24/7 and progressively learning about your browsing habits and everything in between.

The very same formula CX is ML plus UX applies to our financial products.

For instance, a digital banking app that uses alternative social data to create a custom credit score and issue a consumer loan within 3 seconds.

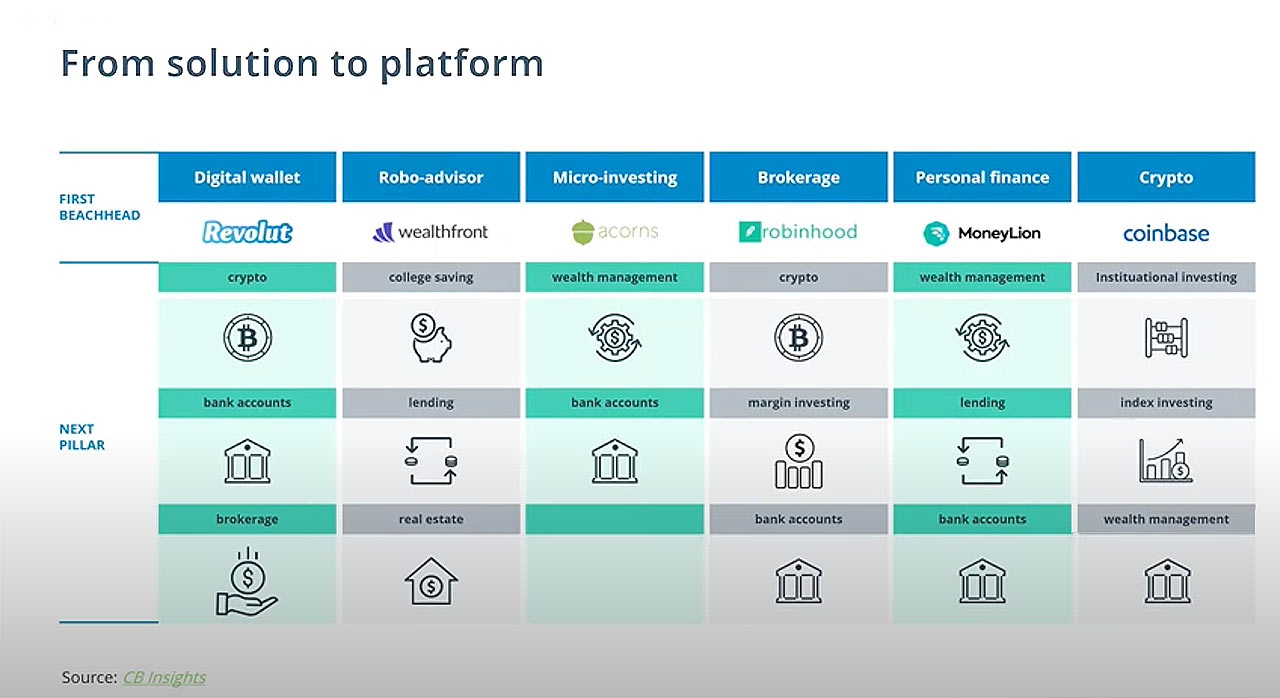

But does the future of fintech really drift towards the super app model? The data say so. And mature fintech players are already following this consumer satellite. So, why is this happening? Why are we seeing the platformization of fintech?

45

Two words: a pathetic. People are getting tired from being forced to switch from one product to another, and here is the data to prove that. It's already hinted most mature fintechs owners is bound in trend and actively try to diversify their portfolio of in-app services. They are moving away from being solutions toward becoming platforms.

In the other way, a collection of financial and lifestyle services ranking from walls management to crypto investing and discounts at retailers. All houses under one roof.

Now comes a pitch of salt! As fintech platforms grow more complex and feature headaches, users start complaining about feature or information overload. Guess what? That is the exact same reason why most digits are incumbent bank for intuitive fintech apps in the first place. And here in lies the big problem fintech now needs to solve.

How do you build a technologically advanced financial product without making it too complex? Because, let's be honest, my friend Katya doesn't want to estimate her predictive networks using five different formulas. She does want to know if she can ever afford to purchase a flight in Paris and what mortgage rate she can get.

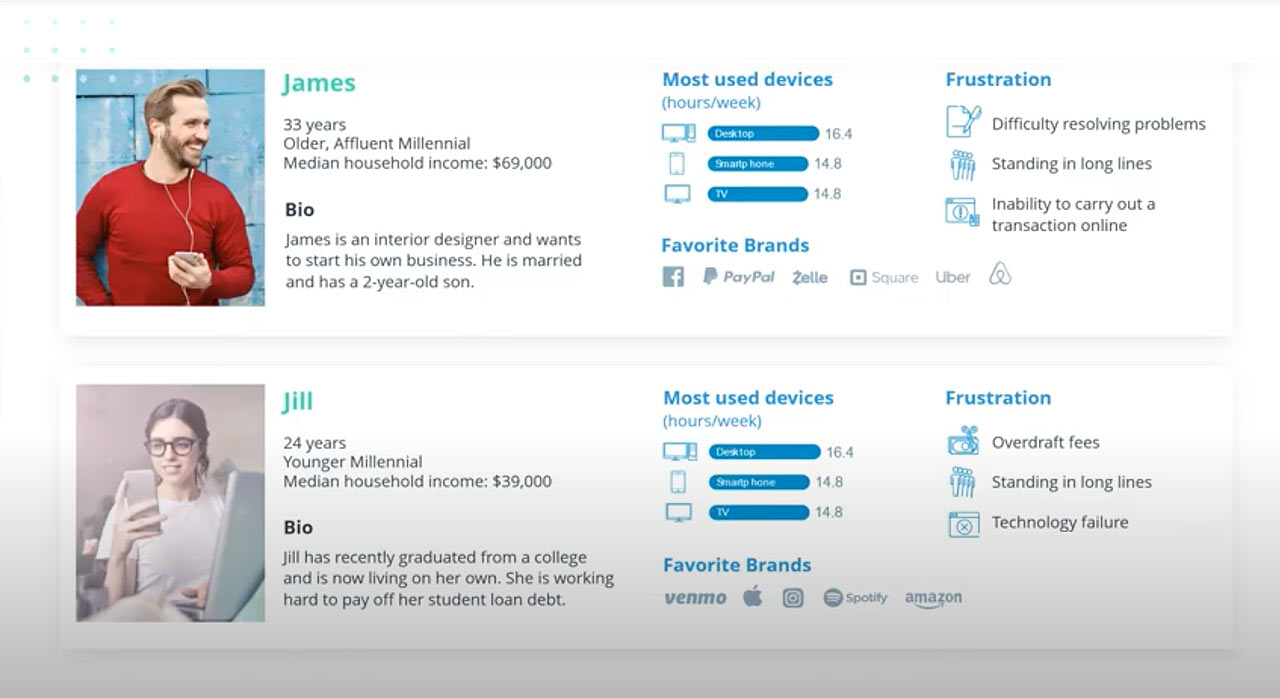

But then my mate Pete is really into trading, and he wants to get personalized robo advice for a portfolio of stocks bones and crypto assets. So, how do you align your product with such different customer journeys? How do you make your financial product as engaging as Tik Tok without making it as complex and notorious as Night Capital power pack algorithm?

Offering less with more is a new challenge for mature fintechs. How do you solve it? My answer is: by applying this formula. Customer experience is machine learning plus user experience.

Customer experience is a buzzword. I bet you already heard someone saying CX at least a dozen times during this Day. So, rather than giving you regular Definition, I will share a quick story instead.

Today we have millennial consumers, the folks holding the largest buying power, and by 2030 also the largest fraction of disposable wealth - thanks to their inheritance from boomers.

If you spend at least a minute online, you know all the labels the generation gets: the self-absorbed and selfish folks, who are also guilty of self-care and don't mind spending a few dollars here and there on a fine meal or super promo. And somehow most of us - the millennials - end up with enough money for an avocado toast, but too little for a real vacation or ever certain food on the home ownership ladder. Anyone can relate? As a millennial myself, I usually do not agree with those stereotypes, but when it comes to banking i become that self-absorbed person.

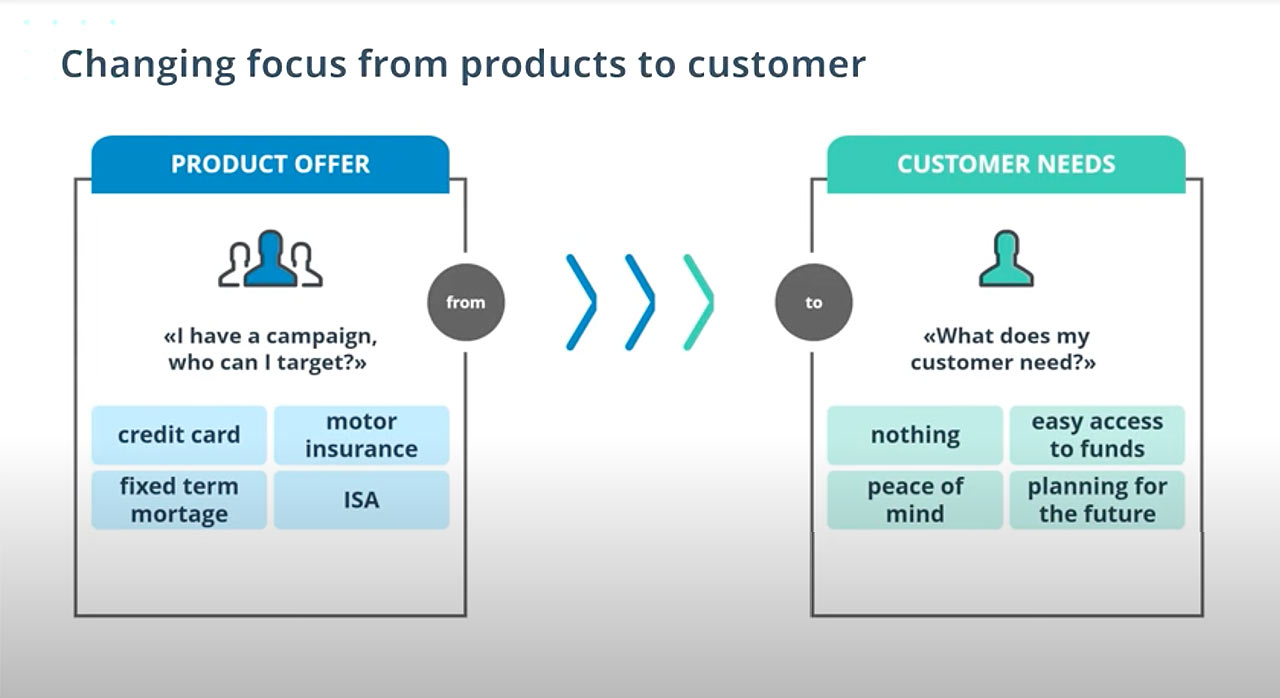

Because here is the thing: most of the time I don't look for specific banking products! I want to watch out for some solution to fulfill my selfless a- the-moment needs. For, example find a way to save for a trip abroad, stash some money for my wedding or just assess if I could ever afford a house of my dreams. My customer journey is strongly alive with my life journey. However, when it comes to product Development, most fintechs work from the opposite angle: instead of trying to manage their product with the users actual needs, a lot of product owners build their customer journeys around products in their portfolio.

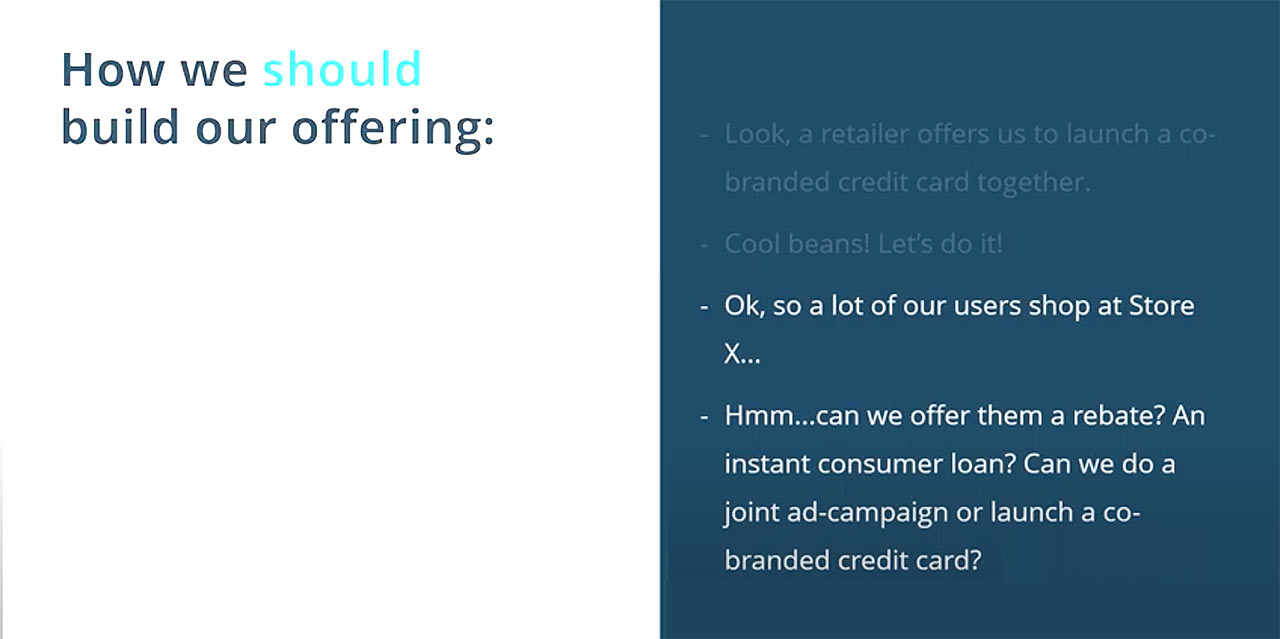

And the story goes like this. Look: a retailer offers us to launch a co-branded credit card together. Cool bean! Let's do it!... When in reality, your product development story should go like this: “okay ,so a lot of our users shop at Storage…. can we offer them a rebate, an instant consumer loan? Can we do a journal ad campaign or launch a co-branded credit card?”.

As fintech settle for the fast portfolio center approach, most customers don't get those sweet what's in it for me offers. Instead they are posted with irrelevant Upsells.

But most of your customers want to feel special during all stages of the banking journey. The best part? You already have all the keys to make that happen. As a fintech, you're already sitting on a data goldmine that describes your customers spending preferences (transaction data) and indicates a current life stage: age, social data, spending.

What you need now is to release the data from product silos. Doing so can help you step away from managing accounts towards offering a truly personalized experience for each customer.

Right, but how do I figure out what my customers need? First, use the data you have. Second, design machine learning algorithm to crunch it for you. And third - receive next best action Suggestions.

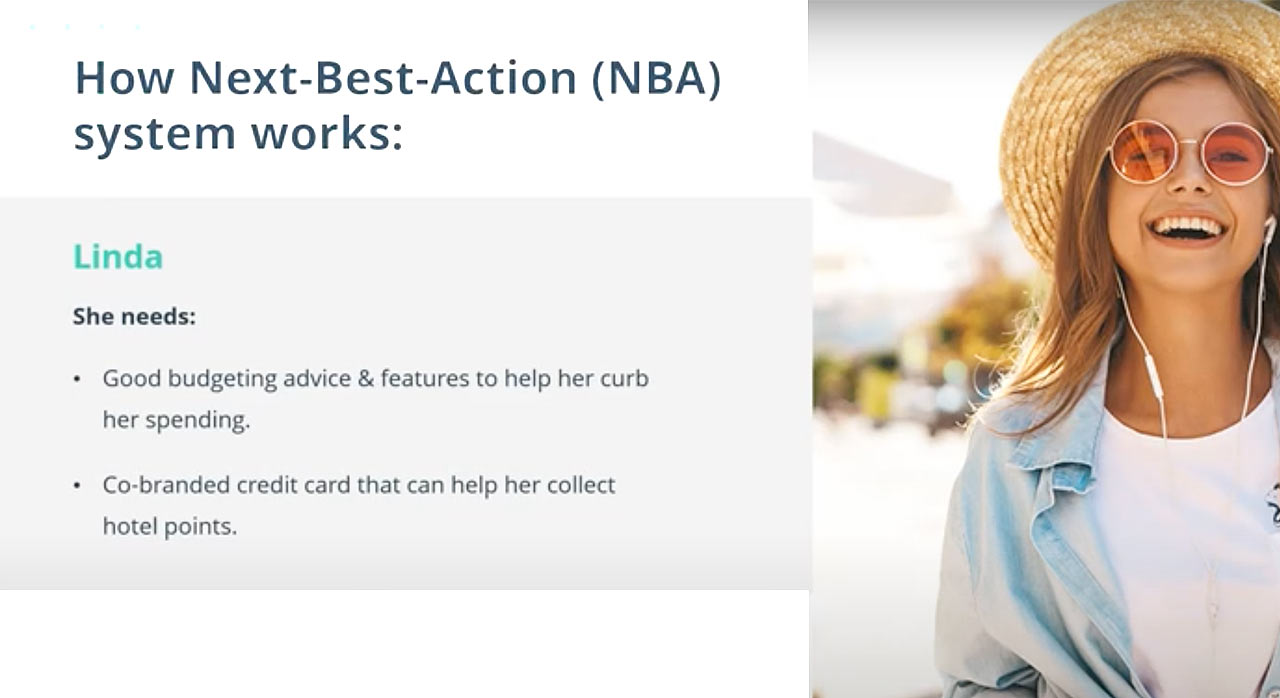

Here is how such NBA systems work. One of your customers – Linda - booked a flight to Mallorca in six months, but her savings account is nearly empty. So what does Linda need? First, some good budgeting advice and features to help her carve her spending. Secondly, a co-branded credit card that can help her collect hotel points.

She has a good credit standing already (just in case you are worried). How do you find sanchelin does among hundreds of thousands of customers in your CRM? With the help of predictive banking analytics and propensity models. The current state of ML lets you determine micro customer segments and pitch them ultra-personalized offer in near real time. By using your data sets such algorithms can tell you what to sell, when to sell that product and when doing nothing is the best option. That is how you keep your customers engaged at scale.

And here are a few more other ways how the NBA concept can be used in fintech.

1. Deliver a hyper hyper-personalized offer services and rewards to individual customer. Using predictive analytics fintech company can create dynamic personas and target users with relevant deals based on their spending data, location, common purchasing behaviors and past responses to campaign. You can deliver such pitches as in-app messages app notification or as personalized advice from an in-app AI assessor.

2. Improve cross sales, upsells and product recommendation. Your AI power system can help you map the correct product with the most likely buyer, plus predict which financial service your customer will likely need or buy next. Such predictive powers help you deliver superior customer experience.

After all, by knowing what your customer is up to next - going abroad, buying a house, having kids - your teams can facilitate that person on their journey and help them meet their goals faster.

What's more? You can also dynamically track and review previous offers to avoid pitching the same product to the same users over and over again and annoying the heck out of them in between.

Morgan Stanley has recently launched wells desk, and next best action wealth management platform for their advisors. In essence is the advisor's second AI brain whispering them all the right moves. Here is how wellesdex supports their teams. First, provides real-time advice for clients based on their life events. For example, if a client has a child with an illness, the system could recommend the best local health care options - schools and financial strategies - for managing the illness.

Since personalized real-time updates to advisors, such as low cash balance alert, notification above major increases or decreases in clients portfolio and so on. This allows a Morgan Stanley team to respond faster and more effectively to various events on their customers journey offers more traditional rob advising.

The system collects recommendations and insights for clients and suggests them to advisors, so that they could advise better.

To get a step ahead, fintechs can also adopt similar NBA solutions. But use conversation AI interfaces instead of financial advisors to build that kind of personalized report with each customer and offer them optimal advice. And that's where the true power of machine learning for customer experience management lies.

Now let's move on just to the second element of our formula: user experience. Here is some uncomfortable truth: millennials financial literacy isn't great. There are two things millennials struggle with most: understanding financial risk and risk management, and figuring out insurance. And there is some connection here, right?

And this is a big deal, because risk and uncertainty are wired into most financial decision making. Could anyone predict the recent drops in stocks back in November? Nope. Do we have any idea about where the commercial real estate market is going? Not much. And while those two are complex questions, most users also need support with simply saying: “can I enforce this paychecks? What happens if I invest in six stock?”. Good financial products must educate their users.

But how do you teach folks who don't want to be preached about the importance of the boring financial stuff such as budgeting, ftp's a mutual fund? You make your product highly intuitive and incorporate progressive discovery and learning. Borrowing approach from sales companies, you need to build a smooth funnel for moving people from being financial beginners to regulars, and then product champions, and likely brand ambassadors. You do so by creating a streamlined and effective user experience flow within your product.

So, what's the anatomy of effective user experience for a fintech product? Let's break it down together.

Most people use financial apps daily. Clearly, your customers want fast access to their money and all the features for managing it. Ff course, you don't want to stand in their way, but remember - there is also security! You can't let just anyone in. The best way to secure account access is to use biometric solution: touch id, face id, voice id. You can use this to grant access to your core account features, plus you can pair biometric with multi-step authentication for more sensitive actions, such as changing card withdrawal limits or making large transfers.

Monster, for instance, allows users to authorize p2p transfers with a fingerprint, but relies on advanced verification for bank transfers.

Getting sign-up for your product should not require a finance degree or take 14 plus day, and at least three post office runs, and that's for the digital account company. Your goals is to make the onboarding process a delightful conversation, not a daunting routine.

Being a mobile solution gives you plenty of advantages: a camera to capture ID documents, biometrics collections, social media data, location-based services, but don't go all giddy and grab all the data you can! Request only the information you need to verify new customers, so that they can quickly get access to their account, and then you can progressively open up access to additional services, as a new customer perform various action in your app, in raza transforms in the score as well.

You can add extra KYC procedure for more sensitive operations, such as trading lending, to stay on top of compliance.

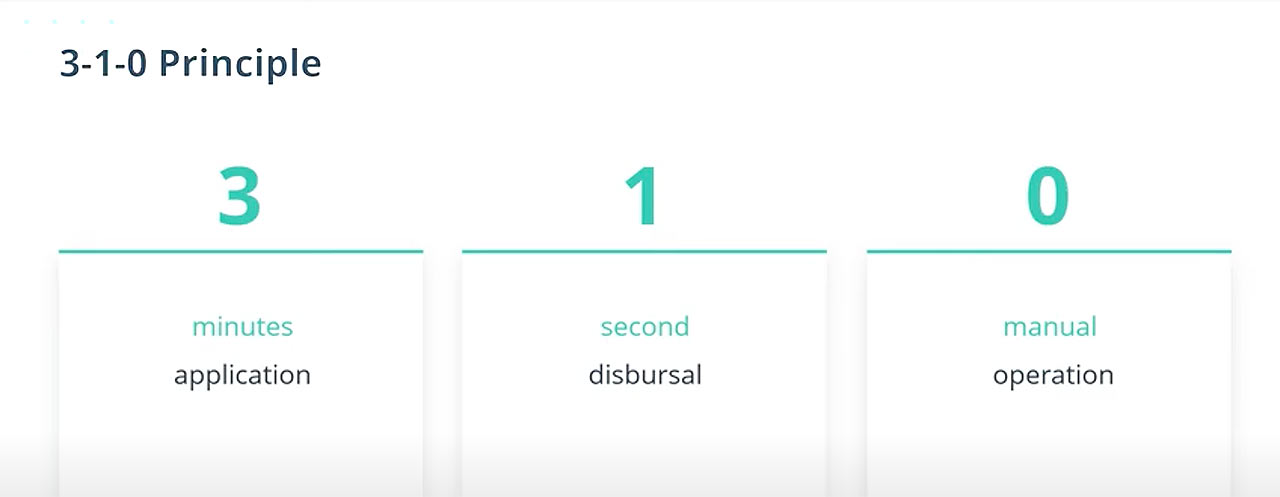

Here is how mybank part of ant financial and the super app employs all the latest stagins are 310 approach to learn application. They have three minutes application process for all new customers. Instead of asking for direct input, MyBank sync most of the customer data from other profile they have within the end financial ecosystem.

Approval for a consumer loan take one second, and all of this happens with zero manual backoffice operations. Machine learning algorithm and predictive analytics take care of those. Your goal is to get people using your product as fast as possible, so that they can move from a novice to regular users, then developers take a habit and eventually become loyal adapts who raise your company's bottom lines.

That's why getting a debit or credit card post verification should take just a few step. Square cash is a great example of how that's done.

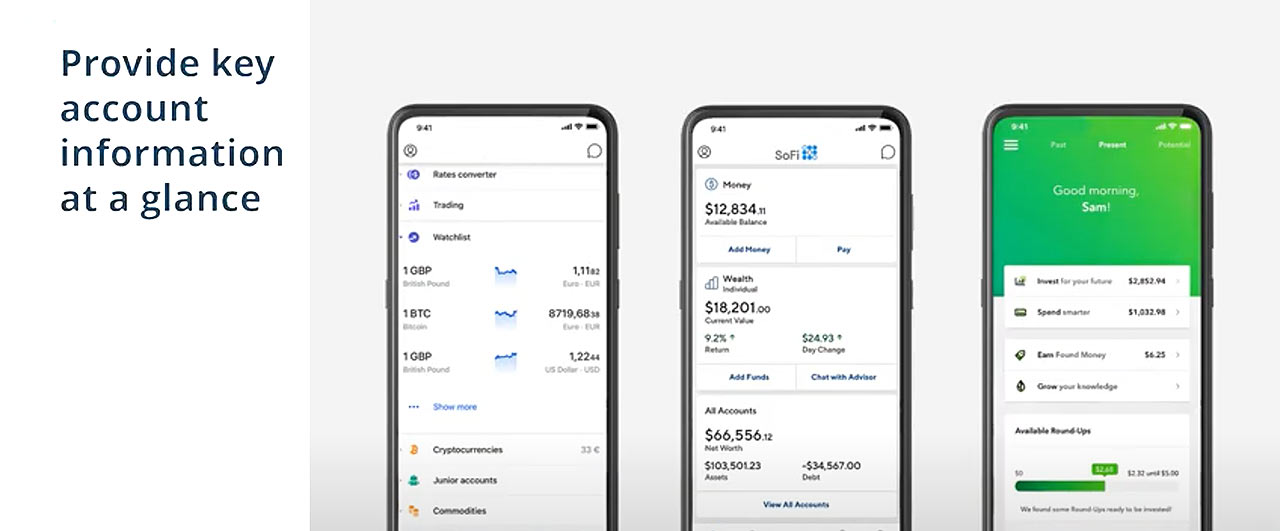

Next, your users should not base brain power on figuring out the state of their finances. All the key data should be available at a glance. Revolut does a pretty good job within its main screen: the app offer progressives a one-top discovery of key insights, plus you can seamlessly navigate to additional features, such as a top-ups in a few tabs. If you want to get an edge, you can also introduce a more advanced analytic dashboard that shows users how they are doing in terms of meeting their financial goals.

If they are on top of their saving, for Example, you might suggest portfolio allocation or send other personalized roles management advice. So find nicely pack all key insights into one neat interface. Finally, don't forget about educating your user about their account options and personal finances.

But don't be too Pushy: your goal is to show and tell, not preach.

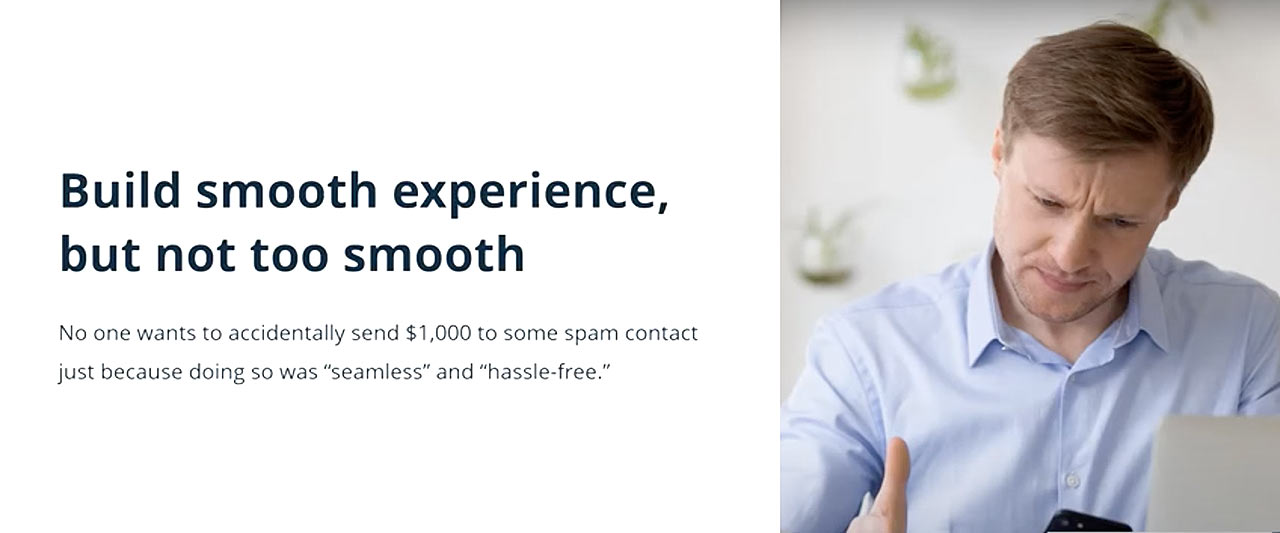

Acorn is one of the few fintech apps that offers nice stream of educational content together with CNBC. This may sound counter-intuitive, but bear with me for a second! PayPal, Venmo and the like sets the bar for quick and easy payments. Borrowing a messenger UI to design a similarly smooth money transfer or account top-up experience is a good idea. But a zero friction UX can do more harm than good in fintech products. Money matter after all, a serious business.

No one wants to accidentally send one thousand dollars to some spam contact just because doing so was seamless and hassle free. That's why it's important to add some intentional friction whenever the user wants to make any major in-app actions or permanent account changes. Think confirmation of pop-ups, two-factor authentication and other minor roadblocks that prevent people from taking their own actions. Balancing a smooth experience and necessary friction is essential for fintech products.

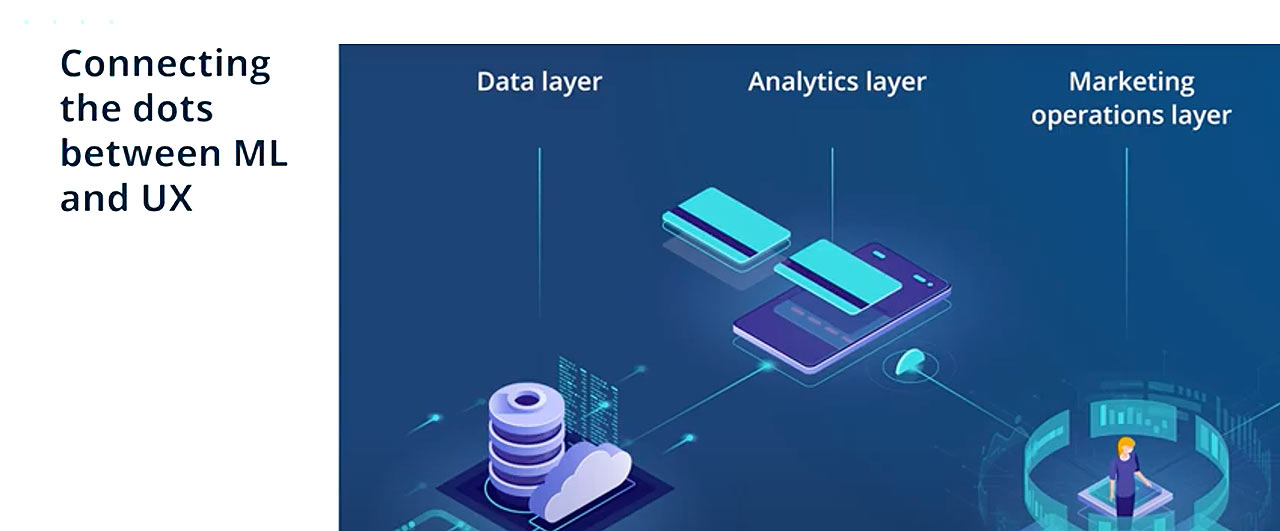

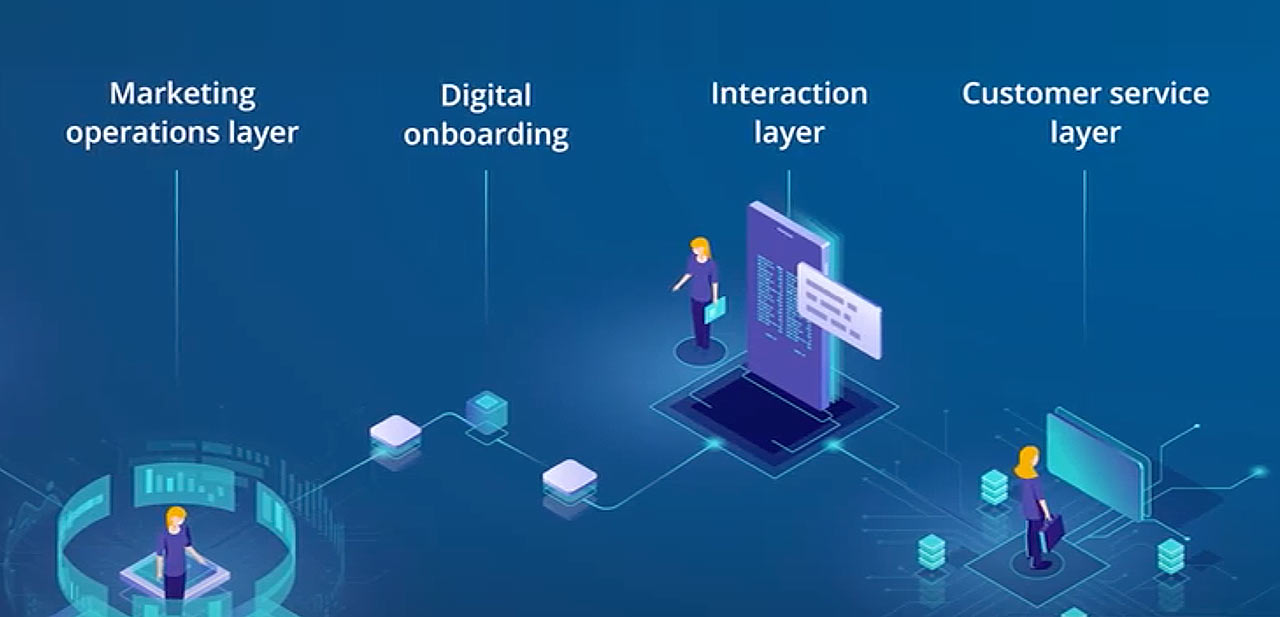

The next logical question is how do you reconcile that shining front end with all your middle-office and backoffice operations plus spring kills at machine learning on top? To accomplish that you will need to organize your product at 6 different levels.

Let's go on a quick journey with Carol, our millennial protagonist and a lawyer bank customer. First, you will need to learn about her Habits: what she earns, what she spends on and where she invests. All of this data needs to be stored in a secure data lake: the place where machine learning algorithm will go fish for data.

Setting up a data lake platform is the first step towards predictive analytics and ML, aka your analytics layer. This have you got that Carol falls into a customer segment A and will likely respond well to product A, B, but not C. Whenever Carol goes browsing for a new credit card, her action triggers a marketing operation layer. Automatically she receives a series of personalized in-app messages encouraging her to look more into product A and B.

A few days later Carol is ready to sign up for a new credit card. Your analytics layer already marked her as a good candidate, so she begins her journey to digital onboarding and gets approval for a new card in three seconds.

Now she just needs to assign some documents and choose her card design. Carol's been enjoying her card for six months now. She always pays off head balance on time and her credit score remains high.

One day, however, your analytics-driven interaction layer noticed that Carol didn't get her paycheck on time. You auto send a quick reminder about late credit card fees and, to reward her loyalty, offer to waive a late payment fee for one month. Carol is pumped and accepts the deal, but she also wants to learn more about her credit card fees.

That's where your customer service layer comes into play. First, Carol hopes to relevant self-help resources. Afterward she uses a chatbot to get some more info, and then requests help from a support agent, who already has all the information about her prior queries.

Eventually the custom support agent offers her an even better credit card product and helps her transition. Carol remains a loyal and profitable bank user for another five years.

By creating a strong alignment between these six layers you can cook the ideal customer experience for fintech product.

Let's sum things up. Excellent customer experience is a strong differentiator between traditional banks and fintech products. But as your product becomes more mature, featuring a larger portfolio of in-app services, it becomes more challenging to maintain that simple and intuitive flair.

Machine learning can help you get that bar high, as it allows you to delight users with ultra personalized deals and suggestions relevant to their current life stage.

An effective UX prompts new users to progressively discover new apps feature and products without feeling overwhelmed. Well advanced type can also enjoy access to more sophisticated functionality. And that's how you align your product development with customers journeys similar to Carol’s, Linda's and many other millennials consumers looking for their next primary financial product.