In Market Research

The happiness box. How a clothing delivery service surpassed Apple in innovation: Stitch Fix blue ocean strategy

Management

Retail had usually interested Katrina Lake, the youngest lady CEO to ever lead a US preliminary public supplying. But she could not assist noticing that the age-antique enterprise in no way changed. Brick-and-mortar outlets nevertheless competed on range and touch-and-feel, at the same time as on line competition sought to distinguish via low expenses and rapid shipping. She found out that synthetic intelligence and human beings — in particular, stylists — might be creatively leveraged to alternate the retail price proposition, create a basically exceptional and appreciably advanced purchaser experience, and a differentiated and low-value supplying.

The case describes how Lake became a Harvard Business School elegance task right into a $1.5 billion company, Stitch Fix. Stitch Fix presents a non-public styling provider, sending in my opinion decided on apparel and add-ons primarily based totally on consumer alternatives and constraints. Buyers get hold of the knowledge, creativity and fashion knowledge of human stylists, blended with the advantages a top-tier AI presents.

These are mixed right into a provider formerly reserved for the wealthy (non-public styling), introduced without delay to customers' homes, at a rate factor that suits their budget. Lake's Stitch Fix is based and led through girls, and has certainly considered one among the most important lady control and workforces withinside the AI area, if now no longer nearly all industries. As of 2019, Stitch Fix employs greater than 6,six hundred employees, of which 86% are girls.

The case works specifically properly for coaching approximately girls in business. It additionally appears at current tries through Amazon to leap into the blue ocean Stitch Fix created. This ends in an exciting dialogue approximately the in all likelihood effect of Amazon's Personal Shopper provider, inviting scholar enter on a way to counter Amazon's attack.

Considering the Stitch Fix Blue Ocean Strategy, the following point are interesting:

- How Stitch Fix overcame intense investor reluctance to elevate price range from early-level buyers and mission capitalists who did not purchase into her concept, with an open dialogue on how she would possibly have greater efficaciously labored via those troubles and the position gender would possibly have performed in her very tough adventure to elevate price range.

- How Stitch Fix unlocked a differentiated and low-value supplying leveraging each the trendy synthetic intelligence and the brilliance and creativity of human beings, particularly stylists, to open new marketplace area in retail. This case is the various first to discover how an business enterprise can efficaciously leverage each AI and human non-public interplay to create a basically new supplying.

- How to assume past the limits of an present enterprise, escape of bloody competition, and create a brand new marketplace area.

The story of the smart online clothing shop Stitch Fix, whose model Amazon tried to copy

The founder of Stitch Fix, Katrina Lake, taught algorithms to match clothes to users' tastes and created a company with a $2.4 billion market cap.

In July 2019, Amazon launched a new project, a service to deliver clothing kits based on personal stylist recommendations Personal Shopper.

Amazon decided to copy the business model of a similar American service, Stitch Fix. It was created in 2011 by Katrina Lake, a Harvard graduate.

Thanks to stylists and machine-learning algorithms (Netflix's head of analytics helped create them), the service selects and delivers sets of clothes to customers according to their taste.

The company is now capitalised at over $2.4 billion and Katrina Lake has become the youngest woman in the world whose business has held an IPO.

Stitch Fix blue ocean strategy: Shopping for the future

Katrina Lake planned to become a doctor following her father's example and even enrolled at Stanford University Medical School. There Lake realised that she didn't want to wear the same boring medical uniform day in and day out, and was more interested in economics than medicine.

With a bachelor's degree in economics, in 2005, Lake joined the Parthenon Group, a consultancy firm. She consulted for companies in the retail sector, had a lot of contact with entrepreneurs, and realised that the market needed a start-up at the intersection of fashion and technology.

How will we be buying jeans in 10 years' time? I knew it would not be like before: go to six shops, choose a few pairs, try everything on.

And I knew it wouldn't be like today's online shopping model: you have 15 tabs open in your browser, you check sizes and look for reviews from other shoppers. Then you order a few pairs and return what doesn't fit.

Katrina Lake

Online retailers, according to the entrepreneur, needed to rethink their customer experience strategy and start harnessing the power of big data.

A promising niche was vacant, but the girl had no plans to launch her own project. She said she looked to the example of Google's founders, programmers Sergei Brin and Larry Page, who set up the company in a garage, and did not see herself doing so.

Lake wanted to join an established start-up that would offer the online retail market a radical new solution.

In 2007 she became a partner at Leader Ventures - to get closer to IT. However, she was never able to find a suitable project and still decided to launch her own and to do so, she enrolled at Harvard Business School in 2009.

Here, as part of a group project, she presented the idea of a personalised online shopping service. The target audience is women who don't have time to go shopping. With the help of computer algorithms and individual stylist recommendations, shoppers replenish their wardrobe without going to the dressing rooms.

At Harvard, the project was received coolly. One professor even called the startup an "inventory nightmare" - according to Lake's idea, customers' clothes should be stored in their own warehouses.

Despite this, the would-be creator of Stitch Fix began testing the business model on "friends of friends". She would pick up her own sets of clothes, pack them in boxes and send them to customers from her flat, earning $20 from each order.

In 2011, Lake earned an MBA and moved to San Francisco to develop her startup. Her business partner was Erin Morrison Flynn, wife of her Harvard classmate and former buyer for multi-brand retailer J.Crew.

Search for investors

At first it was not easy for Lake and her team to find major funding.

Venture capitalists refused to see Stitch Fix as a business project worthy of attention and money. The very idea of a virtual women's stylist for affordable money was far from their sphere of interest.

Lake recalls attending business meetings with a box of clothes and a personalised card from the stylist. The entrepreneur said investors would take five minutes and then ask perplexedly, "Do you want to get $2 million to buy dresses?"

According to Lake, the main problem was that the project was too "female" for the tech industry: "More than 90% of venture capitalists were men, and I felt the gender dynamics of the industry were working against us.

The Harvard professor was also right: giant warehouses of clothing and hourly pay for freelance stylists did not add to the business' appeal to venture capital funds.

One of the first to be persuaded by Lake, after all, was Baseline Ventures founder Steve Anderson. The company invested $750,000 in Stitch Fix at the very start, in 2011.

Another important investor was the shopping service's regular client Ami Feinberg. She was the personal assistant to Benchmark Venture Capital's general partner, Bill Gurley, and helped Lake set up a meeting with her boss.

As Gerli himself recalls, Feinberg told him, "I think you should know that your female employees spend a lot of money on this service."

In 2013, Stitch Fix closed a $4.75m Series A funding round. In February 2014, the company already employed 455 people. The year before that, it had 49 employees.

Stitch Fix blue ocean strategy: Fashion algorithms

The better and more accurately an online stylist picks up clothes, the more Stitch Fix earns. The company has a traditional retail business model: it buys clothes from brands in bulk quantities and earns money on retail sales.

From the user's point of view, the service works like this: first, the customer fills in a questionnaire, specifies his parameters, his wishes regarding the style and type of clothing, and his budget.

Then they set a delivery date for the container and pay $20 to use the service. You can sign up for regular delivery of clothing sets. Delivery is free; returns are free, too.

On a specified date, the client receives a set of five items selected by the company's stylists. The user has three days to try on the clothes from the parcel and decide what he wants to keep. The rest is sent back.

If the customer doesn't buy anything, they lose a $20 fee. If they keep at least one item, $20 goes towards its price. If you buy all of the items in your collection, you will receive a 25% discount. Items range in price from $25 to $500. The average price of a piece of clothing in a set is $55.

Participants of the first focus groups didn't understand why they would pay $20 for clothes that might not fit them. In Lake's idea, machine learning-based algorithms and a stylist worked together to reduce the likelihood that a customer wouldn't like the contents of a box.

It works like this: as soon as a user fills in a questionnaire, their data goes into Stitch Fix's database. The algorithms process the information and select the kits which the customer is likely to like - amongst the hundreds of thousands of items in the company's warehouse.

The next step is for the stylist to get involved. They take on the role of curator and approve five items of clothing from those suggested by the algorithm - based on the customer's personal preferences. The stylists also take into account the user's weight, marital status and place of residence.

According to Lake, 70 per cent of users place a second order within 90 days of the first order. With each consignment the algorithms get a better understanding of the customer. So they calculate the user's "hidden size" by analysing the items sent back.

Big data allows them to track customer feedback. For example, they used to frequently return classic XXL men's shirts in size XXL, which Stitch Fix's own brand produces.

The team analysed how to reshape the patterns so that customers felt more comfortable. After that, sales of the shirts rose by 40%.

The startup now employs more than 100 data analysts, of whom only six are involved in algorithms for fitting clothes.

Big data is involved in almost all of the company's business processes. They are used to "connect" the service's client with a personal stylist, to build logistics and intelligently manage the assortment in the warehouses.

Stitch Fix blue ocean strategy: Tinder for clothes

In 2018, the company launched its online game Style Shuffle. In it, users rate photos of clothes, shoes and accessories with a swipe up or down. "Tinder for clothes has amassed more than 3 billion unique ratings of things. More than 75% of the company's customers play the game regularly.

For Stitch Fix, this is yet another opportunity to gather even more customer data and improve recommendation algorithms. Style Shuffle helps identify users' latent tastes. That is, clothing that the user really likes, regardless of how they define their own style.

A customer may request a button-down corduroy shirt in a questionnaire, but the online game reveals that they are more likely to "like" clothes made of denim.

Style Shuffle data helps Stitch Fix buyers predict which styles and colours will be popular next season. The service also uses information about customer preferences when developing its own clothing brands.

According to its website, Stitch Fix has launched eight womenswear lines and ten menswear lines. Its data and merchandising team analyses the most popular images to create items that are predictably in demand by customers.

"Homemade" brands allow the company to respond quickly to customer demands and fill niches that are empty in the market. "For example, many female customers in their 40s were asking for hooded blouses, but these were not available in our current range," explains Lake.

How successful Stitch Fix blue ocean strategy is

Katrina Lake was ranked 55th in Forbes' latest ranking of Self-Made Women with a fortune of $380 million. At 37, Lake became the youngest woman in the world whose company went public. It happened in 2017.

Since 2011, the startup has raised $122.4 million in investment. In 2018, Stitch Fix posted a net profit of $1.2 billion. The company now has a market capitalisation of $2.4 billion, according to Yahoo Finance.

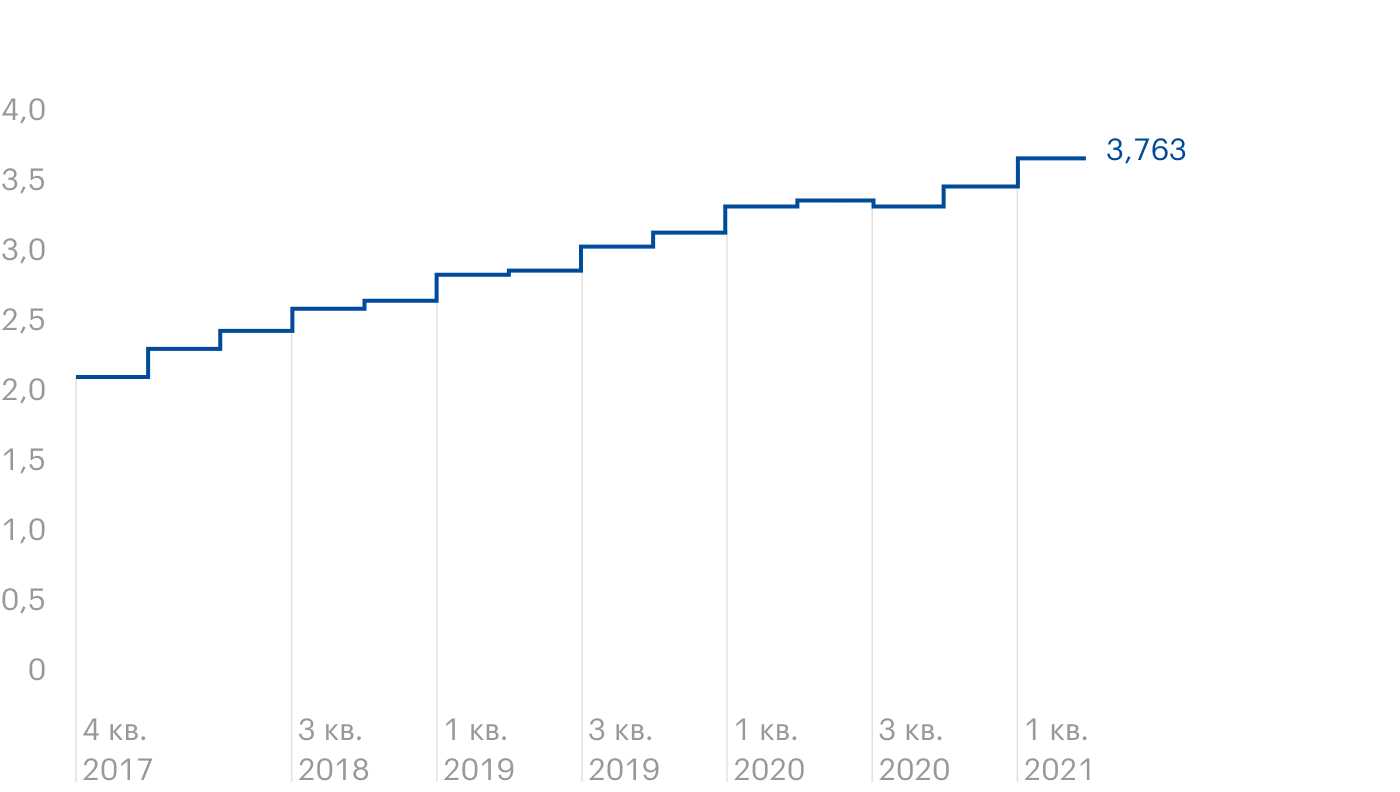

This year, Stitch Fix was ranked as one of the top 10 most innovative companies in the world by the US publication Fast Company. According to Bloomberg, Stitch Fix employs more than 8,000 people. The company also cooperates with 3,700 freelance stylists.

The service is used by 3.1 million customers. The company's product range includes more than a thousand brands, ranging from the mass market to the premium segment. The startup, which originally targeted busy working women, launched a service for men in 2016 and for children in 2018. This year, Stitch Fix began its international expansion, launching in the UK.

Stylists, investors and algorithms: how the Stitch Fix blue ocean strategy works

Stitch Fix (NASDAQ: SFIX) is an American online tailoring platform. The company is hopelessly loss-making, although it has its trump cards up its sleeve. But will it have enough upside for the stock?

How Stitch Fix makes money

According to the company's website, its business works like this. First, a customer creates a personalised profile on the company's platform. A stylist goes into this profile and runs an algorithm that suggests different clothing combinations based on the information received or the customer's purchase history. The stylists review these options and manually select the clothes, and then offer the client a set of several images. The ordered clothes are sent to the client's home, where they are tried on. The client chooses what he/she likes and pays for it, and the rest is picked up by the courier free of charge.

The client pays $20 for this service. If the client buys clothes, he gets a discount of $20 - it turns out that this money he paid not for the stylist, but for the clothes. And if he refuses the order, the client won't get his money back.

The company also has a paid subscription Style Pass, where a client pays $49 a year and in exchange for that can use the services of stylists and measure as many clothes as he wants. Style Pass is only available in the US.

The company only operates in America and England. There are no exact sales figures, but given that 7 of the 8 sorting centres are in the US, the English share is probably small.

In fact, that's about all there is to say about the company's business: the annual report is completely meaningless.

Unexpectedly

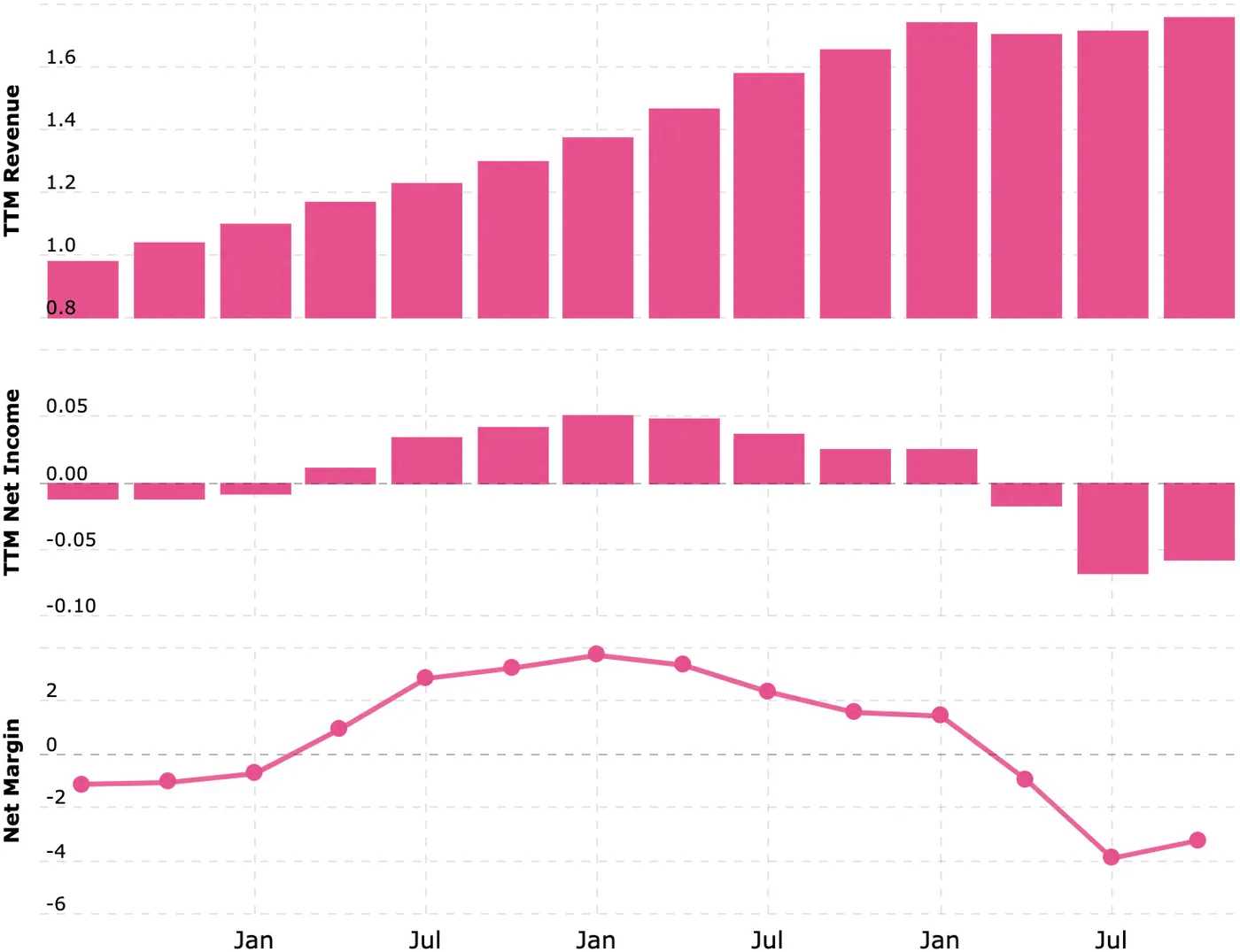

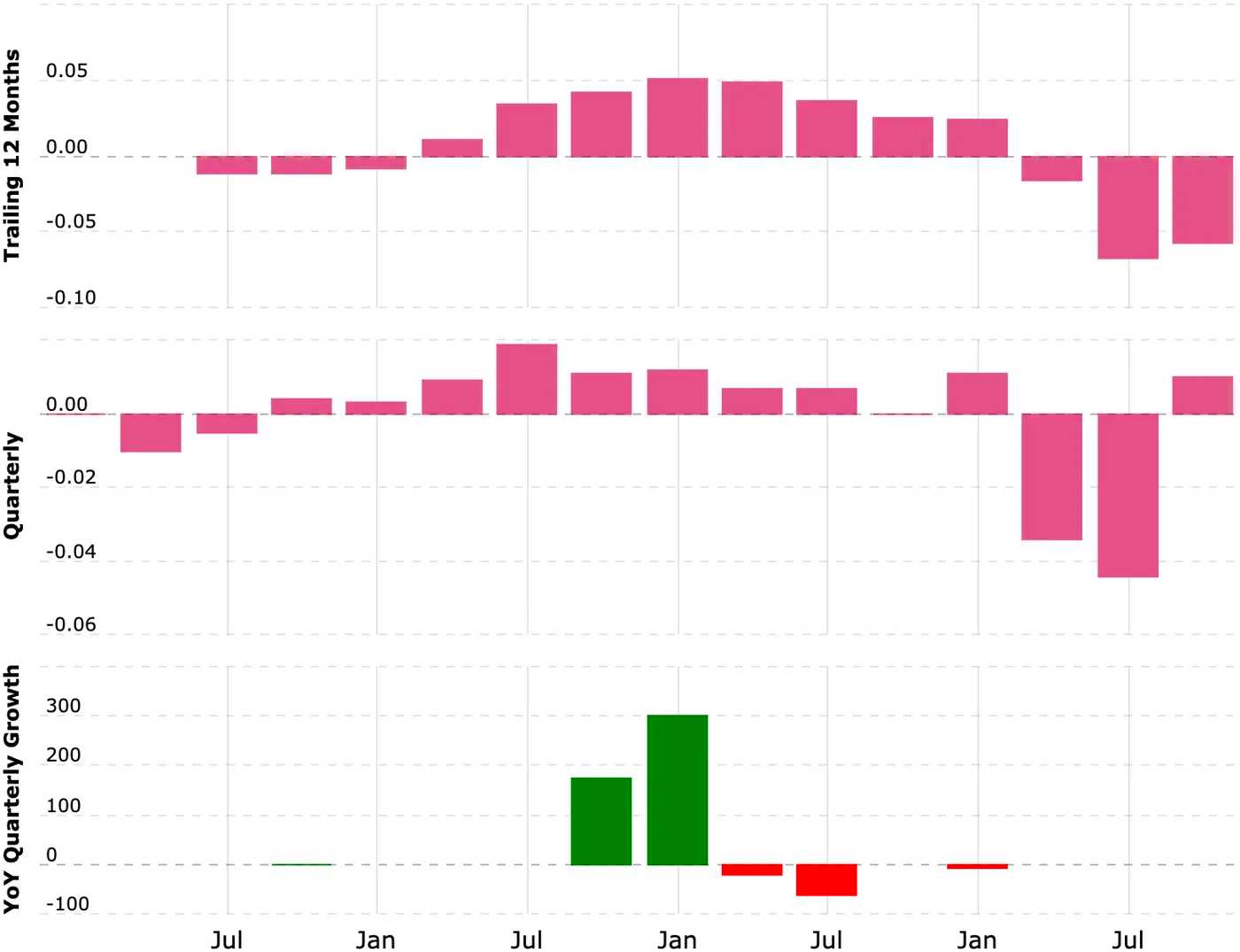

The revenue and profit graph shows that the company is unprofitable. But recently news has come in that Stitch Fix made a profit for the first time last quarter: the company has significantly increased the number of active customers. One might get the impression that the company's business could be promising. Is this the case?

Snitches get stitches

Stitch Fix's business model, particularly its Style Pass service, resembles that of Helios and Matheson Analytics, whose MoviePass app allowed people to go to the cinema every day for free for a fixed subscription price. And in January 2020, the company went bankrupt.

A close look at Stitch Fix's latest earnings report reveals that the company is still operating at a loss, with the upside coming from one-off non-core revenues - mainly tax credits.

At the same time, revenue per active client is falling: the company actively uses ruinous discounts to attract an audience. For example, a customer receives a discount if they buy an entire set of clothes sent in.

The cost of doing business at Stitch Fix exceeds profit, and unlike many IT start-ups like SailPoint, there are few options for optimising revenue through the use of delivery. Huge logistics costs in the online retail sector have stunted the development of even Amazon, which finances its dreary retail business from the profits of its brilliant cloud computing division.

Stitch Fix has less scale and capability than Amazon, and the "send the product to the customer and get it back" style logistics will be unprofitable for a long time to come. It is unlikely to be profitable in the first quarter of 2021: logistics services in the US will be stretched to the limit this year. This means that the company can certainly not hope for lower logistics costs in the near future.

And as for Stitch Fix's profits in the last quarter - Helios and Matheson also once showed a profit, six months before their quotations flew to hell, from which they never returned.

But it's not all that bad

Stitch Fix shareholders have a good prospect - if a bigger company is bought. Management seems to think so too: many reports and presentations of Stitch Fix repeat the unassuming idea that the company has collected "invaluable data on the shopping habits of millions of consumers" and that it might be worth buying just for that. It collects at least 90 different characteristics per customer, and another 80% of users give detailed feedback after purchase. And there's a working matching algorithm, which gives an average guarantee of around 63% that a customer will buy the right set of clothes.

In this regard, the company could be bought either by Amazon or by some luxury clothing investor. Internet penetration in the luxury sector is not yet very high - but it will grow. By the way, even high-end London tailors have been forced to move to remote working and automation. So perhaps Stitch Fix will be bought by someone like LVMH to experiment with a virtual dressing room.

Another question is: when and on what terms will this happen - if at all? The online education platform Pluralsight's shares once dropped drastically, after which news of its purchase by a private fund with a very small mark-up to the stock exchange price came in. In the same way Stitch Fix could be down six times before it is bought for a billion and a half. The company now has $451.6m in debt, of which $295m needs to be repaid within a year, but it has $200.3m on the books. Let's not forget that a substantial part of this money will be used to finance operations: the company is loss-making. Most likely, the company will issue additional shares to pay its debts, and the fact that investors will not appreciate this step - maybe the stock will fall because of it.

Or maybe I overestimate the threat and most investors would be happy to invest in the shares of a "promising start-up" in the same way they invested in Airbnb and DoorDash.

Former Walmart chief operating officer Mike Smith and Netflix head of analytics Eric Colson joined the company in a year. Before that, Colson worked with the project for a year as a consultant.

"He recalled someone at Netflix suggesting: "What if, when we launch the app, we immediately start showing the user a movie that we think they're going to like? ". It seemed like a bold but risky idea to go all in on just one recommendation," says Lake.