Some details

A risk management system (ARM) that detects and blocks any fraudulent activity that fraudster might attempt with the customer’s online banking account or payment card in real-time. Our system proactively monitors accounts and enhances your bank’s fraud prevention and detection by:

- Monitoring transactions for suspicious activity and money laundering violations

- Issuing alerts for various types of bank fraud

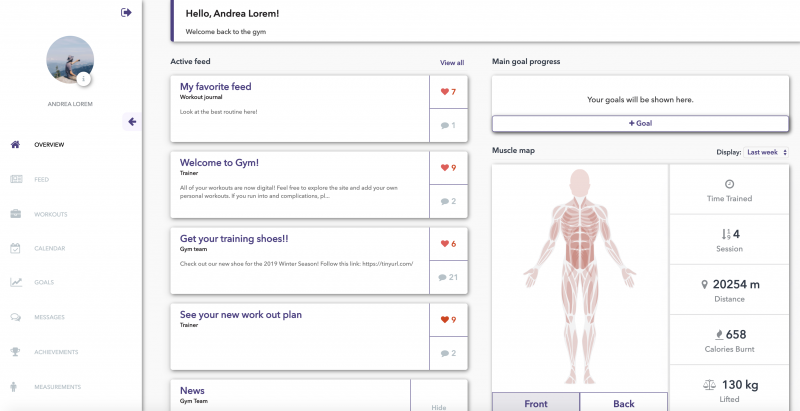

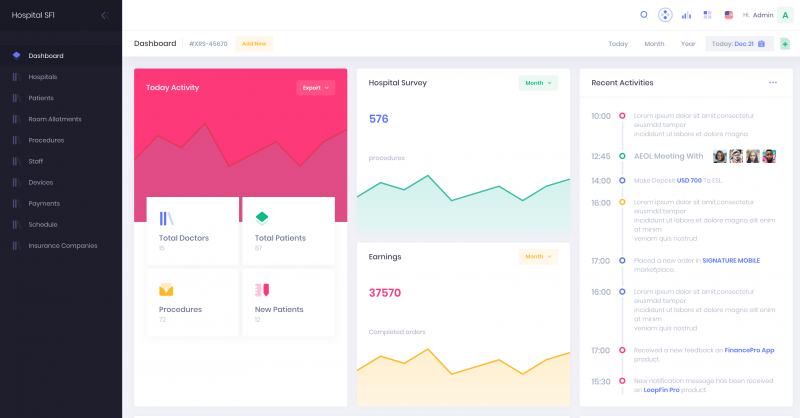

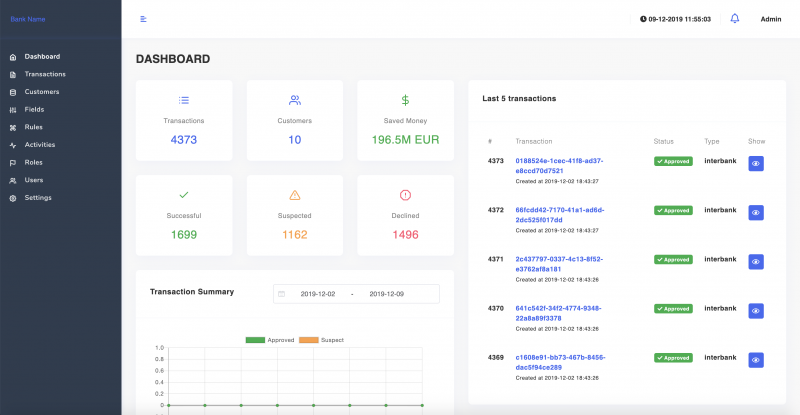

On the main page, which is initially loaded you will see common information about processed transactions:

- How many transactions were made on a selected date?

How many users we have?

How many transactions of the particular type our users made?

Do we have any marked transactions to be processed right now?

How much transactions we can process in a minute and how much we are processing right now?

We also have a simplified version of transactions view for Welcome Page Dashboard which includes:

- User Details: Name, Surname, unique bank ID

- Transaction code

- Transaction status and rules applied to the transaction

Infographics and fast access buttons are an amazing way to make information structured and react on popped events fast to make the user experience even better. All fraud alike transactions will be saved in an encrypted database and shown on the dashboard as a list alongside with extended statistics. We are creating custom dashboards with specific branding for each customer.

Easy integration is crucial for all our customers and we are trying to be as flexible as possible here.

OGD Solutions Automated Risk Management System is a server-side software that is deployed into client infrastructure and could be integrated with any number of data sources (online banking server, payment cards processing system, etc.) and after that in real-time receive data about any activity (any actions with the customer',s account).

Universal API accepts any data elements in requests and forward it to Automated Risk Management System. Data then mapped to system custom fields which are used for rules definition and further evaluation and scoring.

There is also the ability to create custom rules or exceptions for particular cases which also could be easily mapped to existing API services.